10 Simple Techniques For Pivot Advantage Accounting And Advisory Inc. In Vancouver

A Biased View of Small Business Accountant Vancouver

Table of ContentsGetting My Outsourced Cfo Services To Work3 Easy Facts About Vancouver Tax Accounting Company ExplainedThe smart Trick of Outsourced Cfo Services That Nobody is Talking AboutUnknown Facts About Outsourced Cfo ServicesThe Main Principles Of Vancouver Accounting Firm Top Guidelines Of Outsourced Cfo Services

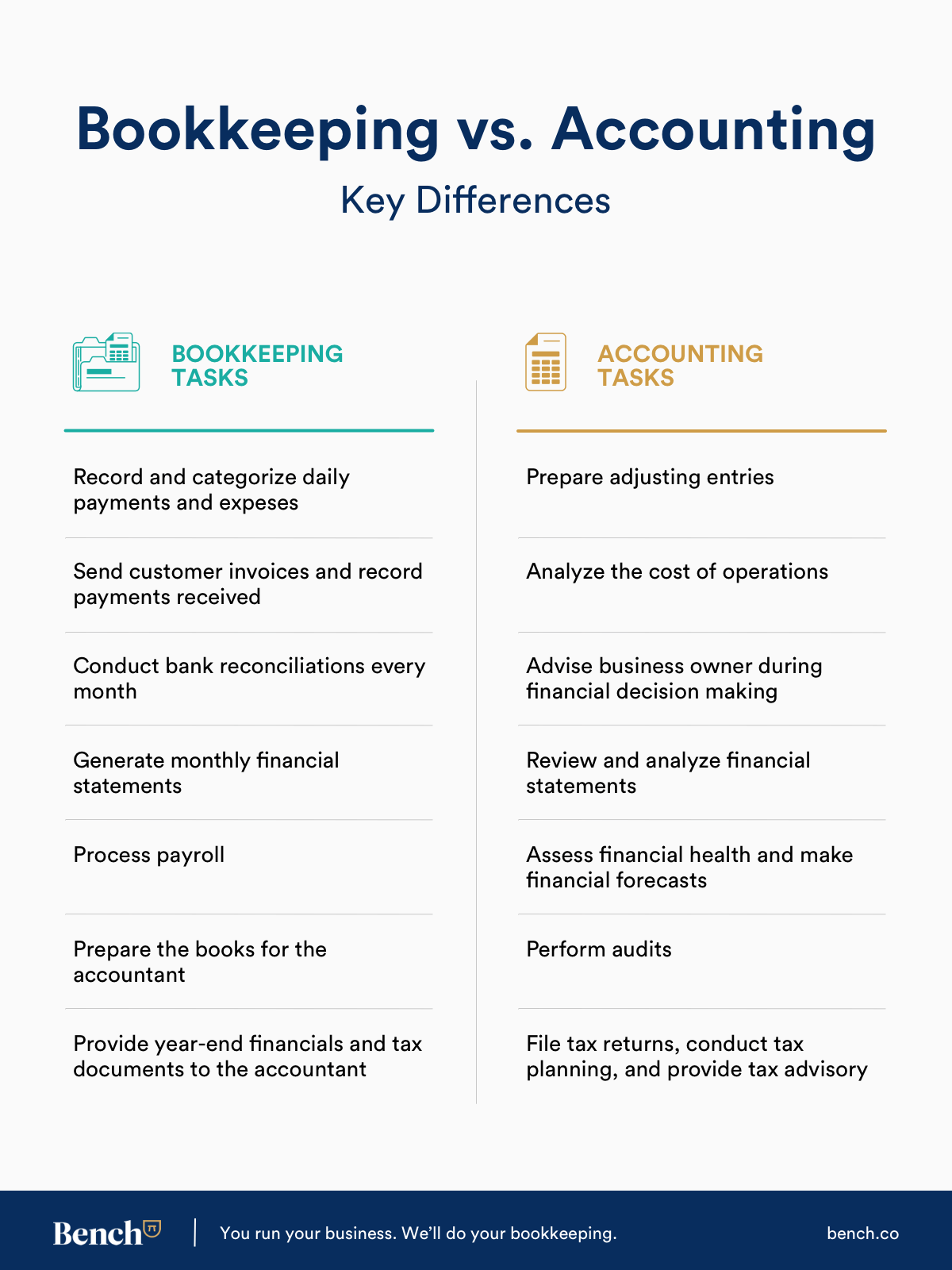

Below are some advantages to hiring an accountant over a bookkeeper: An accounting professional can offer you a comprehensive view of your service's financial state, along with approaches and recommendations for making monetary decisions. On the other hand, accountants are just accountable for videotaping economic purchases. Accounting professionals are called for to finish more education, accreditations as well as work experience than bookkeepers.

It can be hard to determine the proper time to employ an accountancy expert or bookkeeper or to figure out if you require one in any way. While several small companies hire an accounting professional as an expert, you have numerous alternatives for managing economic tasks. Some little organization owners do their own bookkeeping on software program their accountant suggests or uses, supplying it to the accounting professional on a weekly, month-to-month or quarterly basis for action.

It might take some background study to discover an appropriate bookkeeper since, unlike accounting professionals, they are not called for to hold an expert certification. A strong recommendation from a relied on colleague or years of experience are crucial variables when working with a bookkeeper.

More About Cfo Company Vancouver

For local business, adept cash money management is an important aspect of survival as well as growth, so it's wise to work with a monetary professional from the begin. If you prefer to go it alone, think about starting out with bookkeeping software program as well as keeping your books meticulously approximately day. In this way, need to you require to work with a specialist down the line, they will certainly have visibility into the full financial background of your business.

Some source meetings were performed for a previous version of this short article.

The smart Trick of Small Business Accountant Vancouver That Nobody is Talking About

When it pertains to the ins and also outs of tax obligations, accounting as well as financing, however, it never hurts to have an experienced specialist to count on for guidance. An expanding variety of accounting professionals are likewise taking treatment of points such as capital forecasts, invoicing and also HR. Eventually, many of them are tackling CFO-like roles.

As an example, when it pertained to obtaining Covid-19-related governmental financing, our 2020 State of Small Company Study found that 73% of local business owners with an accountant said their accountant's recommendations was very important in the application procedure. Accountants can also assist company proprietors stay clear of pricey mistakes. A Clutch survey of local business owners programs that more than one-third of local business listing unforeseen expenses as their leading financial challenge, you can look here followed by his response the blending of company and individual finances and also the lack of ability to receive settlements in a timely manner. Little business proprietors can expect their accounting professionals to assist with: Selecting business structure that's right for you is necessary. It influences just how much you pay in tax obligations, the documentation you need to submit and your individual obligation. If you're wanting to transform to a various company framework, it could result in tax obligation consequences as well as various other problems.

Even business that are the very same size and also sector pay really different quantities for accountancy. These expenses do not transform into cash money, they are needed for running your service.

7 Simple Techniques For Vancouver Tax Accounting Company

The average expense of accounting services for tiny organization varies for each unique circumstance. The typical monthly accounting costs for a little company will increase as you add more solutions and also the jobs obtain more challenging.

You can videotape deals as well as process payroll making use of on the internet software application. You enter amounts into the software application, and the program calculates overalls for you. In some situations, payroll software program for accountants allows your accountant to provide payroll handling for you at extremely little additional price. Software program services come in all forms and dimensions.

The Single Strategy To Use For Tax Consultant Vancouver

If you're a brand-new organization owner, do not fail to remember to factor accounting expenses into your budget. If you're a professional proprietor, it may be time to re-evaluate accountancy prices. Administrative costs and also accounting professional costs aren't the only audit costs. small business accountant Vancouver. You must likewise consider the results accountancy will carry you and your time.

Your capability to lead employees, offer customers, and make choices can endure. Your time is likewise important and also need to be taken into consideration when looking at accounting costs. The moment invested on accountancy jobs does not generate profit. The much less time you invest in bookkeeping and taxes, the even more time you have to expand your business.

This is not meant as legal recommendations; to learn visit here more, please click below..

The smart Trick of Outsourced Cfo Services That Nobody is Talking About